CHICAGO — When adding more services to retain existing customers and bring new clients in, reactively following competitors or industry trends can not only make these new offerings unsuccessful but can actually damage the profitability of traditional services.

In Part 1 of this series, we explored the value of understanding how to properly assess profitability and calculate a service’s true costs. In Part 2, we looked at some of the traditional mindsets and why they might not apply to today’s marketplace. Today, we’ll conclude by examining ways to determine the balance of new services and old, and how to find the proper mix to build for the future.

Strategic Service Additions

When considering new services, a thoughtful, strategic approach is recommended, rather than jumping into what the cleaner might conclude is “the next big thing.” Brian Johnson, director of training for the Drycleaning & Laundry Institute (DLI), starts with the most fundamental question.

“First, make sure there really is a demand for the service,” he says. “No point of going through all the motions if no one’s going to use it. I think a lot of people in this industry are stuck on, ‘I have to offer this service. I have to be everything to everybody.’ That just may not be the case.”

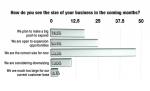

Kermit Engh, managing partner of Methods for Management (MfM), also advises cleaners to do market research first.

“Find out if there is a service that nobody else is offering,” he says, “because in that particular scenario, pricing may be irrelevant. It may be a service that people want, but they haven’t been able to find, and they’re willing to pay for it.”

Beyond market demand, Johnson suggests considering several practical factors: “Will you need any kind of new equipment, new space or new training? Staffing and training is going to be an issue when you start new services. Will adding a new service disrupt your flow for your current services? Make sure whatever you do is efficient. You don’t want to take focus away from the standard.”

He also emphasizes the importance of letting customers know that new options are available.

“If you’re going to offer a new service, do you plan on promoting it?” he asks. “How are you going to market this new thing?”

For significant new service additions, Johnson recommends a phased approach.

“If it’s a big service you’re looking at, you might want to run it through a trial before you commit to it,” he says. “Run a soft opening and launch it as a trial before you go full blast into this new service.”

Balancing Profitability and Customer Value

While profitability must be the primary consideration for any service, Engh acknowledges that customer relationships also play a role in such decisions.

When it comes to factoring in customer lifetime value in relation to marginally profitable services, he suggests engaging directly with top customers.

“I would want to survey, interview or at least get some actual feedback from my top 10% customers, revenue-based, as to what additional services we could provide that would be of value to them,” Engh says.

He cautions against sacrificing business sustainability for customer accommodation: “If it has a detrimental impact on your business because it interferes (with) or disrupts what you’re doing, then I would say figure out how it wouldn’t disrupt, or don’t offer it. We can’t be all things to all people.”

Underperforming Service Decisions

When a cleaner identifies that a service isn’t meeting profitability targets, Engh recommends a structured approach to decision-making.

“The first thing is to actually determine what my cost is to produce this service,” he says. “If I don’t know that, I can’t make any logical, rational decisions. How does it contribute to the welfare of the business?”

The next step is market analysis. “I would do some very simple research to see if I’m priced appropriately in my marketplace,” he says. “Cleaners may find they are severely undercharging for a particular service, guaranteeing that they will never make any money on it.”

When asked for an example of pricing disparities, he points to wedding gown services.

“As I go around the country, I’ve found there is a massive differential in pricing between operators, even in the same market,” he says. “Why is that? You don’t want to copy everybody, but often somebody has figured out a way that they can make a very nice profit on gowns, where somebody else is giving that service away.”

Making Strategic Choices

When it comes to considering new services, Engh and Johnson believe dry cleaners need to move away from reactive, tradition-based service management toward a more strategic, data-driven approach.

This means:

- Developing systems to regularly evaluate the true profitability of each service

- Considering all direct and indirect costs when calculating service profitability

- Questioning industry traditions, such as loss leaders, which may no longer be effective

- Monitoring KPIs to catch profitability issues early

- Taking a systematic approach to adding new services

“Find out what the customer’s pain point is,” Engh says, “and then analyze to see, if I offered that service, how would it affect my company, and how will it enhance my relationship with my top customers?”

For Part 1 of this series, click HERE. For Part 2, click HERE.

Have a question or comment? E-mail our editor Dave Davis at [email protected].